Course Descripton:

This course provides an introduction to the global oil-market system and, secondarily, the increasingly

internationalized gas market and their geopolitics. A central theoretical underpinning of the course is

how the political economy of oil in the previous neo-colonial era and that in the current globalized

capitalist era differ, imbuing .the role of oil. (or gas) in geopolitics in each respective period with

its own logic, constraints and imperatives.

1st OIL: We begin with today's "one global barrel" market-centered oil system, in contrast

to the late-neo-colonial, non-market system that succumbed to the OPEC Revolution's nationalizations and to the

two energy crises of the 1970s. This global market is itself the key element of today's collective

international oil-security system. After reviewing the extent and geo-location of energy resources and

production, recent technological advances, sources of demand and oil-price history, we examine the role of

the US among OECD states as the present system's initiator, and the subsequent gradual development of the

market-centered system's norms and control institutions including: its spot and futures markets traded in

dollars with attendant legal and regulatory apparatus; the role of the OECD's International Energy Agency

(IEA) in running the strategic-petroleum-reserve (SPR) treaty system and in providing transparent and

objective market data and analysis, the system-control role of OPEC (esp. its dominant member, Saudi

Arabia) and OPEC's present coordination with Russia in regulating market supply, and etc. From this

political-economic framing, we examine geostrategic issues and conflicts.

This is accomplished by studying selected conflicts in each distinct period, including in:

- The Non-Market/Neo-Colonial Era (German oil strategy in WWII; the 1956 Suez Crisis; Iran's 1953 oil nationalization

attempt leading to the US-British coup; and the USA's MENA-regional ascendency via non-military means);

- The Transition Period (1973 Arab-Israeli War and AOPEC embargo, 1979 Iran Revolution and the 1985 Saudi "net back"

crisis); and

- The Present Global Market Era (the 1991 & 2002 Iraq Wars; the US-Iran "nuclear" confrontation under Bush and Obama,

and Trump administration's current JPCOA exit, maximalist demands and renewed sanctions, together with Saudi-Iranian regional

contention, which may lead to US interventions and/or a regional war).

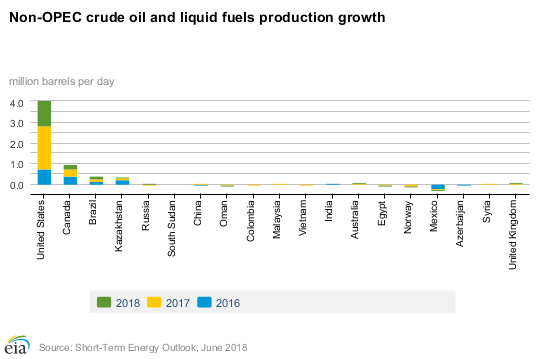

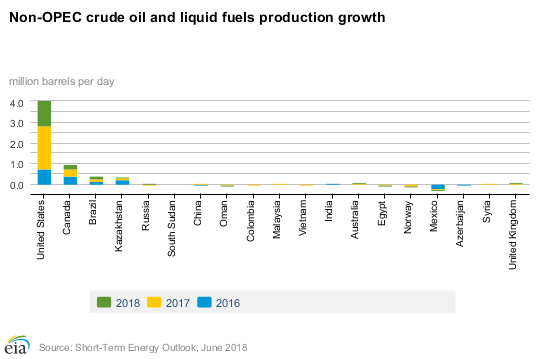

Throughout, the evolving roles and interests of China, Russia and EU states are considered. We also consider Trump's US

"energy dominance" policy, and the fracking-tech revolution that has made the USA the number-one oil producer since 2013

Throughout, the evolving roles and interests of China, Russia and EU states are considered. We also consider Trump's US

"energy dominance" policy, and the fracking-tech revolution that has made the USA the number-one oil producer since 2013

2nd GAS: Gas demand is increasing as coal (and in Germany, nuclear) is phased out. Gas also provides rapid

electrical-generation response to weather-variable wind and solar, while liquefied natural gas (LNG) will increasingly replace

diesel in heavy trucking and ocean shipping. While northern EU states and especially Germany likely will have pipeline suppliers reduced to a

"duopoly" of Norway and Russia in a decade, concerns about Russian use of gas as a geopolitical lever present the EU with an

imperative to diversify supplies. In this regard we examine EU policy in the wake of the continuing Ukraine crisis, and

repeated Russian gas-transit cutoffs.

In particular, we examine the crisis of German energy-security involving (a) complications in advancing its Energiewende plus

(b) its strategy of avoiding energy-security risks from the Ukrainian-Russia conflict by taking over Ukraine's

Russian-gas-importing role (i.e., the Nord Stream 2 pipeline), a strategy opposed by the USA and most Eastern and Central

European states. The Trump administration presently intends to stop Nord Stream 2 via sanctions on German and other EU firms

partnering with Russia on the project.

We examine how the fracking revolution has made the USA since 2011 the world's main producer of natural gas, presently

building massive liquid natural gas (LNG) export capacity, as Australia and Qatar have already done and Russia hopes to do.

The majority of long-distance traded gas will soon not depend on pipelines, but be traded by ships, bringing about a

globalized gas system, with few locked-in bi-lateral pipeline dependencies, and regional prices gradually unifying into a

global market, shifting the geopolitics of gas to resemble that of oil.

REQUIREMENS: Active participation in seminar discussions and engagement with assigned readings. Each

student or a team selects, with instructor approval, a region and/or topic to focus on throughout, including a research paper

and final presentation. It is expected a number of experts from diplomacy and/or energy industry will speak with the class

on at least two occasions.

|