I. FINANCIAL MANAGEMENT AND THE PLANNING-CONTROL CONTINUUM

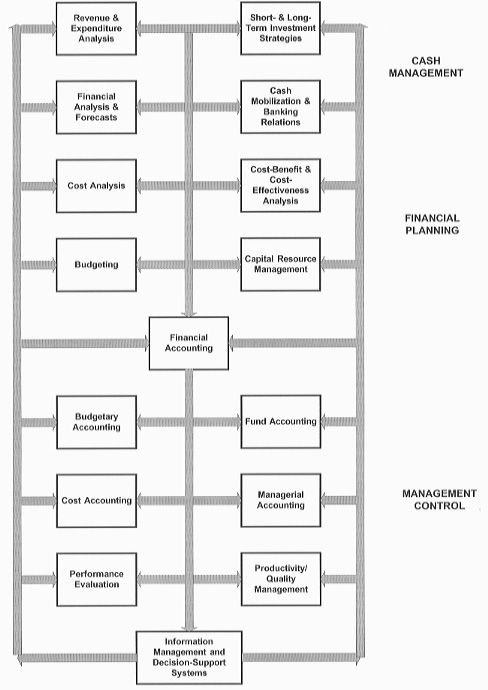

Faced with an accelerating rate of change in technical, political, social, and economic forces, the management of public organizations has become more difficult, requiring greater skills in planning, analysis, and control. The basic components of financial management are outlined in Exhibit 1.

Exhibit 1. Linkages Among the Financial Management Cycles

OBJECTIVES OF FINANCIAL PLANNING AND MANAGEMENT

Government exists to provide services and facilities that individuals or businesses are unable or unwilling to provide for themselves.

o Determining whether the commitment of governmental resources improves conditions in the broader community can be complicated, particularly when no basis exists for assessing the value of such actions to individuals.

o Essential tools for financial management include techniques for assessing the long-term needs of an organization and its clientele, rational procedures for acquiring and allocating the resources necessary to meet these needs, and appropriate mechanisms for managing costs, maintaining accountability, and disseminating relevant financial information.

A traditional role for financial management has been that of "keeping score"--accounting for revenue (income) and expenditures (expenses).

A financial plan projects resource requirements for specific time periods and identifies the likely sources of the funds needed.

Managers must identify the magnitude of future needs, determine their timing, negotiate to achieve the appropriate resources to meet these needs, allocate existing resources (budgeting), and manage costs.

A basic objective of cash management is to minimize opportunity costs, while maintaining a sufficient cash balance to meet the day-to-day needs of the organization.

Revenue and Expenditures Analysis

Financial management and planning is complicated by the multiplicity of local jurisdictions that makes it difficult to achieve appropriate economies of scale in the delivery of public services.

Local government expenditures for various public services have been increasing at phenomenal rates.

o Local revenues have tended to increase at a much slower rate, creating an ever widening financial gap.

o In economic terms, it is said that local government revenues are relatively inelastic, that is, most local sources of revenues are not particularly responsive to changes in the overall economy.

Property Taxes

Property taxes have proven to be relatively unresponsive in meeting increasing demands for public services and facilities.

Property taxes support many local services which are not based on user-benefit, often resulting in a regressive impact with respect to income.

Real property tax is levied on the assessed valuation of taxable land and improvements, thereupon

Personal property tax is, or has been at one time or another, applicable to the assessed value of taxable tangible personal property, e.g., furniture and equipment, automotive equipment, animals, and inventories, and taxable intangible personal property, e.g., money, stocks, bonds, and other assets representing a property right that is not tangible in character.

Local Nonproperty Taxes

Local sales taxes are levied on retail sales of tangible personal property. Sales taxes are not inelastic, but vary less widely during business fluctuations than do the yields of net income taxes.

Gross receipts taxes are imposed on businesses and occupations and are measured by the gross income of the undertaking and, in some areas, have replaced former flat-rate business licenses.

Selective sales taxes may be levy on specific commodities or services in lieu of a general retail sales tax: public utility taxes; admission and amusement taxes; motor fuel and motor vehicle license taxes; business license taxes; and local taxes on alcoholic beverages and tobacco.

Income taxes have been applied at the local level to: (l) gross income from salaries and wages of residents earned both within and outside the city; (2) gross income from salaries and wages of nonresidents earned within the city; (3) net profits of professions and businesses of residents from activities wherever conducted; and (4) net profits of professions and businesses of nonresidents and of corporations from activities conducted within the city.

Service charges are amounts received from the public for performance of specific services benefiting the person charged and from sales of commodities and services--except by city utilities--and generally bear a direct relation to the cost of providing the service.

Licenses and permits involve charges that often are less than the actual cost of the administration of a government activity.

Special assessments differ from taxes in that they are related to a specific benefit, need not be uniform throughout the jurisdiction, and generally allow no exemptions.

Financial Analysis

Baseline funds support the current, ongoing operations of the organization and are used to pay current operating expenses, provide adequate working capital, and/or maintain current plant and equipment.

Strategic funds are invested in the new programs to meet strategic objectives--to purchase new assets, such as equipment, facilities, and inventory; to increase working capital; to support direct expenses for R & D, marketing, advertising, and promotions; and for mergers, acquisitions, and market development.

Computer-assisted methods are available to: (1) analyze cash flow requirements, (2) optimize financial leverage, (3) project financial statements, (3) compare lease versus purchase options for difference depreciation schedules, (4) evaluate impacts of proposed organizational changes, and (5) assess impacts of risk and uncertainty on financial decisions.

Forecasting

Public organizations must develop reliable estimates of their cash flow positions in order to maximize returns on their financial assets.

A forecast is an approximation of what will likely occur in the foreseeable future, the objectives of which is to provide a basis on which to measure differences between actual events and the plan adopted to achieve certain objectives.

o Forecasts form the basis for a cash budget, which is used to monitor how much money will be available for investment, when it will become available, and for how long.

o The investment strategy of any organization must be strongly correlated with the accuracy and timeliness of its cash budget.

Cash Mobilization

Cash mobilization falls into two areas: (1) acceleration of receivables--funds that come into an organization's treasury; and (2) control of disbursements--funds paid out to vendors and others who have provided services to the organization.

o Operating decisions stem from the policies of the organization and result in adjustments in the inflow and outflow of cash.

o Capital expenditure decisions that affect the infrastructure of the organization give rise to the outward flow of cash.

o Credit decisions involve the time an organization takes to make payments to its vendors, as well as the length of time a client/customer may take to make payment without penalty.

o Investment decisions result in the use of inactive cash to purchase financial assets or the liberation of funds by the sale of such assets.

o Financing decisions involve the acquisition of new money by selling bonds, borrowing, or increasing revenues (e.g., by raising user charges, prices, or increasing taxes).

Lines of credit--commitments by banks to make loans available subject to certain conditions--are important hedges against unanticipated contingencies, such as temporary financing needs and short-term cash flow shortages.

Idle funds, such as checks sitting in safes, cash registers, or desk drawers over the weekend or even overnight, can earn income for the organization if invested in short-term securities.

Investment Strategies

The ideal investment is one that yields a high return at no risk, offers promise of substantial growth, and is instantly convertible into cash if money is needed for other purposes.

A fundamental objective of financial management is to maximize yield and minimize risk.

Primary determinants in selecting a specific security are: (1) safety/risk, (2) price stability, (3) liquidity and marketability, (4) maturity, and (5) yield.

Effective management requires the application of planning and analytical techniques to accommodate the risk and uncertainty that are inevitable in future-oriented decisions.

An effective manager, whether in the public or private sector, must be aware of how opportunity, innovation, and risk are interrelated and must be willing to take risks appropriate to his or her level of responsibility.

Cost Analysis

Cost is a common denominator in the use of the various resources of any organization.

o No program decision is free of cost, whether or not the decision leads to the actual commitment of organizational resources.

o Future costs that cannot be easily measured in dollar terms all-too-often are dismissed as non-cost considerations.

Costs can be measured in various ways, depending on the information requirements of management.

o An attempt must be made to find predictable relationships between a dependent variable (cost) and an independent variable (some relevant activity), so that costs can be estimated over time based on the behavior of the independent variable.

o Costs are allocated according to their variable, fixed, direct, and indirect components.

Monetary Costs and Economic Costs

Cost factors should be considered throughout the analysis: (1) in developing plans and programs; (2) in preparing budget requests; and (3) after commitments have been authorized, as programs or projects enter the implementation phase.

Research and development costs, investment costs, the cost of operating, maintaining, and replacing programs and facilities are monetary costs commonly reflected in financial accounting.

Some program costs are fixed (that is, they are the same regardless of the size or duration of the program); other costs are variable and may change significantly as the scope of the project or program is increased.

It is important to consider the marginal or incremental costs of increasing the size or scope of a program.

Direct costs represent costs incurred for a specific purpose that are uniquely associated with that purpose.

Indirect costs are associated with more than one activity or program that cannot be traced directly to any of the individual activities.

Controllable costs are defined as those costs subject to the influence of a given manager for a given time; noncontrollablecosts include all costs that do not meet this test of "significant influence" by a given manager.

Economic costs include:

o Opportunity costs occur if the commitment of resources to one program preempts the use of these resources elsewhere.

o Associated costs are any costs involved in utilizing facilities or services; for example, the cost that users must pay to travel to public recreational facilities, or the cost that government incurs to provide highway access to such facilities.

o Social costs may be defined as the subsidies that would have to be paid to compensate persons adversely affected by a project or program for their suffering or "disbenefits."

Activity-Based Costing is a process-oriented method, based on the recognition that labor-intensive processes may represent the single largest contribution to the increasing cost of doing business, which provides a more representative distribution of resource use since cost allocations are based on the direct cost drivers inherent in the work activities that make up the organizational structure.

Cost-Benefit and Cost-Effectiveness Analysis

Two approaches may be taken to cost-benefit analysis: (1) to maximize benefits for an established level of costs or a predetermined budget; or (2) to determine the minimum level of cost necessary to achieve some specified level of benefits.

The basic components of Cost-Benefit Analysis:

o Selection of an objective function involves the quantification (in dollar terms, to the extent possible) of costs and benefits to facilitate the comparison of alternatives.

o Constraints are the "rules of the game"--that is, the limitations within which a solution must be sought.

o Externalities--side effects or unintended consequences that may be beneficial or detrimental--may be excluded from the analysis initially in order to make the problem statement more manageable.

o In examining the time dimensions of various alternatives, it is necessary to delineate life-cycle costs and benefits.

The present value of both costs and benefits must be determined by multiplying each by an appropriate discount factor.

o Benefits that accrue in the present are usually worth more to their recipients than benefits that may occur in the more distant future.

o Funds invested today cost more than funds invested in the future since one alternative would be to invest such funds at some rate of return that would increase their value.

Cost-effectiveness analysis can be viewed as an application of the economic concept of marginal analysis.

o The effectiveness of a program is measured by the extent to which, if implemented, some desired goal or objective will be achieved.

o The analysis must always move from some base that represents existing capabilities and existing resource commitments.

The analytical task is to determine the most effective program, where the preferred alternative will either (1) produce the desired level of performance for the minimum cost or (2) achieve the maximum level of effectiveness possible for a given level of cost.

Budgeting

A budget traditionally has been used as a control mechanism to ensure fiscal integrity, accountability, and legal compliance.

The object-of-expenditure budget has two distinct advantages:

(1) Accountability--an object classification establishes a pattern of accounts that can be documented, controlled, and audited; and

(2) Management Control--control mechanisms for enforcing allocation and allotment limits are supplied through such devices as line-item allocations, periodic budget reports, and the independent audit at the end of the fiscal year. Since personnel requirements are closely linked with other budgetary requirements, the management of positions can be used to control the whole budget.

Although seldom practiced today, many characteristics of performance budgeting have survived.

o Work-cost data are reduced to discrete, measurable units to determine the performance efficiency of prescribed activities.

o Performance measures--workload and unit cost measures--and the concept of levels of service have been incorporated into contemporary financial management applications.

o The focus on cost-efficiency--a hallmark of performance budgeting--has its parallel emphasis in current budget and accounting formats.

Program budgeting combines planning with the basic functions of management and control.

A program is a distinct organization of resources directed toward a specific objective: (a) eliminating, containing, or preventing a problem; (b) creating, improving, or maintaining conditions affecting the organization or its clientele; or (c) supporting or controlling other identifiable programs.

Results to be accomplished within a specific time period should be specified, and program objectives must be consistent with the resources available (or anticipated).

Service level analysis seeks to identify essential service levels so that such services can be maintain and deliver--and be accounted for--in a more efficient and effective manner.

Capital Facilities Planning and Programming

The term capital facility refers to any project having a long life (usually a minimum of 15 to 20 years), involving a relatively large investment of resources of a nonrecurring nature, and yielding a fixed asset for the community or organization.

Capital facilities planning should be built upon a continuous assessment of community/ client preferences, demographic estimates, economic forecasts, and projections of development expectations.

For any given budget period, the overall cost of capital projects proposed will likely exceed the available financial resources, and therefore, proposed projects must be evaluated and rated against an explicit set of criteria

A capital improvements program (CIP) usually spans a five- to six-year period, providing sufficient lead time for the design and other preliminary work required by such projects.

Projects included in the CIP should be arrayed according to their priority ranking.

Debt Financing and Administration

A sound long-range revenue program seeks to develop an appropriate mix among these three methods of financing capital improvements:

o "Pay-as-you-go" financing from current revenues is more feasible when capital expenditures are recurrent, either as to purpose or as to amount, as for example, the paving of streets or the acquisition of neighborhood recreation areas.

o In financing capital facilities through a reserve fund (sometimes called a capital reserve), a portion of current revenue is invested each year in order to accumulate sufficient funds to initiate some particular project in the future.

o Long-term borrowing may be appropriate under the following conditions: (1) where the project will not require replacement for many years; (2) where the project can be financed by service charges to pay off revenue bonds; (3) where needs are urgent for public health, safety, or other emergency reasons; (4) where special assessment bonds are the only feasible means of financing improvements; (5) where intergovernmental revenues may be available to guarantee the security of the bonds; and (6) for financing projects in areas of rapid expansion, where the demands on municipal resources are comparatively large and unforeseen.

A bond is a promissory note ensuring that the lender will receive: (1) periodic payments of interest (at some predetermined rate) and (2) at the due date, repayment of the original sum invested.

Debt administration refers to the management of funds for the construction/acquisition of fixed assets.

o Capital project funds account for the resources used to build or buy specific capital facilities which come from the issuance of bonds or other long-term obligations, from intergovernmental grants, or from transfers from other governmental funds.

o Debt service funds account for: (1) the accumulation of resources from which the principal and interest on general long term debt is paid and (2) the investment and expenditure of those resources.

o A sinking fund spreads the cost of repayment over the life of the bond issue to avoid large, irregular demands on the organization's annual budget.

Accurate debt records develops confidence on the part of investors and the general public as to the management of the financial affairs of the jurisdiction or public organization.

Financial accounting is concerned primarily with the historical results of fiscal transactions and the consequent financial position of some organizational entity.

The basic financial accounting equation can be expressed as follows:

Assets = Liabilities + Owner's Equity + Revenue - Expense

Revenue represents an inflow of money and/or other representations of value in return for selling goods or providing some type of service.

Expense represents an outflow of resources, or incurring of obligations, for goods and services required to generate revenues.

Net income is simply the excess of revenue over expense.

Whereas profit entities seek to generate net income, not-for-profit organizations strive to "break even"--that is, to balance revenues and expenses.

A balance sheet shows the financial position of an entity at a particular time--resources available (assets) and liabilities outstanding (obligations and debts).

Owner's equity--sometimes called net worth, capital, or proprietorship--represents the residual interest in the entity after various obligations have been deducted; in governmental accounting, the concept of fund equity is substituted for owner's equity.

Fund accounting provides the primary mechanisms for the control of governmental activities.

Revenues are controlled through the appropriation process, whereby public agencies are authorized to incur financial commitments based on estimated revenues to be collected.

A fund is an independent fiscal, accounting, and often legal entity to which all resources and related liabilities, obligations, reserves, and equities are assigned.

Separate financial statements are prepared for each of the major funds, and combined statements of funds with similar purposes often are distributed.

Budgetary accounting, with its emphasis on budgetary controls, represents a major distinction between financial management in government and in the private sector.

o The budget serves as both a mandate for and a limitation on spending--adoption of a budget by the legislative body represents the legal authority to spend

o Proposed expenditures are controlled through budget line-items--such as salaries, supplies and materials, travel, contractual services, or equipment--which cannot exceed the dollar amount that has been appropriated or allocated to that particular line item.

Appropriations may be subdivided according to agencies, programs, and classes of expenditures.

Allocations may be made to specific line items or object codes, and specific limitations may be imposed as to the deviations permitted within these expenditure categories.

An allotment system further subdivides allocations into time elements--for example, monthly allotments for personal services (salaries and wages).

Encumbrances record the placement of purchase orders or the letting of contracts as an obligation against the agency's allocation, preventing overspending of the funds available during any fiscal period.

Cost accounting ensures the proper recording of cost flow by assembling and recording all elements of expense incurred to attain a purpose, to carry out an activity, operation, or program, to complete a unit of work or project, or to do a specific job.

Managerial accounting involves the formulation of financial estimates of future performance and the analysis of actual performance in relation to these estimates (program evaluation and performance auditing).

Performance Evaluation

A performance evaluation involves:

(1) an assessment of the effectiveness of ongoing and proposed programs in achieving agreed-upon goals and objectives and

(2) an identification of areas needing improvement through program modification (including the possible termination of ineffective programs), which

(3) takes into account the possible influence of external as well as internal organizational factors.

An evaluation can focus on the extent to which programs are implemented according to predetermined guidelines (process) or the extent to which a program produces change in the intended direction (impact).

As Rossi has observed: "Evaluations cannot influence decision-making processes unless those undertaking them recognize the need to orient their efforts toward maximizing the policy utility of their evaluation activities." [1]

Productivity/Quality Management

While several models seek to address the issues of performance, productivity, and quality, actual programs tend to be hybrid systems--even when labeled as a productivity measurement system, a participative management process, or a quality management approach.

Perhaps the most important lesson to learn from the efforts to improve productivity and the quality of services is the fact that it is relatively easy to establish a productivity/quality improvement program. The hard part is to sustain such efforts.

THE PLANNING-CONTROL CONTINUUM

The basic objectives of financial management define a planning-control continuum.

Kast and Rosenzweig have defined planning as:

. . . the process of deciding in advance what is to be done and how. It involves determining overall missions, identifying key result areas, and setting specific objectives as well as developing policies, programs, and procedures for achieving them. Planning provides a framework for integrating complex systems of interrelated future decisions. Compre-hensive planning is an integrative activity that seeks to maximize the total effectiveness of an organization as a system in accordance with its objectives. [2]

Traditional planning efforts tend to be "one-shot optimizations," drawn together periodically, often under conditions of stress.

A plan is of relatively little value if it does not look far enough into the future to provide a basis on which change can be logically anticipated and rationally accommodated.

Fixed targets, static plans, and repetitive programs are of relatively little value in a dynamic society.

Strategic planning focuses on: (1) the definition of problems (2) consideration of relevant alternatives; and (3) the establishment of strategic objectives and policy guidelines.

Management planning involves: (1) programming approved strategic objectives into specific projects, programs, and activities; (2) designing and staffing organizational units to carry out approved programs; and (3) budgeting and procuring the necessary resources to implement these programs over some time period.

Operational planning is concerned with on the tactics of performance, the setting of standards for the use of specific resources to achieve strategic objectives, and the scheduling of detailed program activities that are integral parts of the strategic and management plans.

Some form of control has been exercised for as long as formal organizations have existed. Increased emphasis on accountability, efficiency, and effectiveness in the public and private sectors has made imperative the application of more effective control techniques.

Mockler suggests that control is:

. . . a systematic effort to set performance standards consistent with planning objectives, to design information feedback systems, to compare actual performance with these pre-determined standards, to determine whether there are any deviations and to measure their significance, and to take nay action required to assure that all corporate resources are being used in the most effective and efficient way possible in achieving corporate objectives. [3]

Strategic controls are used to evaluate the overall performance of an organization or a significant part thereof. When an organization fails to meet broad expectations, the remedies may include the recasting of goals and objectives, a reformulation of plans and programs, changes in organizational structure, improved internal and external communications, and so forth.

Management controls involve the measurement and evaluation of program activities to determine if policies and objectives are being accomplished efficiently and effectively and to ensure that resources are used appropriately in the pursuit of strategic objectives.

Operational controls seek to assure that specific tasks or programs are carried out efficiently and in compliance with established policies by (1) considering the costs of several alternatives; (2) establishing criteria for resource allocation and scheduling; (3) providing a basis for evaluating the accuracy of estimates and the effects of change; (4) assimilating and communicating data regarding program activities, and (5) revising updating operational plans.

The relative mix of these planning and control components may be determined by management styles and the complexity of organizational structure.

Principals and techniques of management have been closely linked with the objectives of control and efficiency.

o Efficiency is linked to the use of organizational resources--when fewer resources are used to accomplish the same results, or when additional results are attained using the same resources, then a program or set of activities is said to be more efficient.

o An organization is effective only when its goals and objectives are accomplished.

Management must adopt a planning perspective to be responsive to changing needs of an organization and its broader environment (e.g., client groups or the public).

Control without planning can do little to reduce the uncertainty that surrounds many of organizational activities.

Information Managemnent Systems

Information is incremental knowledge that reduces uncertainty in particular situations.

Although vast amounts of facts, numbers, and other data may be processed in any organization, what constitutes management information depends on the problem at hand and the particular frame of reference of the manager.

o Information consists of data that have been classified, categorized, and interpreted and are being used for decision making.

o In addition to storing raw data, an information management system (IMS) is a repository for information by which decisions can be tested for acceptability.

Contemporary management activities are both information-demanding and information-producing.

o An IMS must provide important feedback--soundings, scanning, evaluations of changing conditions that result from previous program decisions and actions.

o The specific objective of an IMS is to communicate information in a synergistic fashion --where the whole becomes greater than the sum of the individual parts.

Organizing for Financial Planning and Control

The distribution of financial planning and management responsibilities within local government may vary considerably, depending on the size and form of govermnment, existing legal parameters in state and local laws and ordinances, past practices and traditions, and the management styles of those individuals with overall executive responsibility.

| Director of Finance | ||||

| Handles debt administration | Supervises all finance activities

Advises Chief Administrator on fiscal policy Manages retirement & other city investments |

Makes interim and annual financial reports | ||

| Controller | Assessor | Treasurer | Purchasing Agent | Budget Officer* |

| Division of Accounts | Division of Assessments | Treasury Division | Purchasing Division | Budget Division |

| Keeps general accounting records

Maintains or supervises cost accounts Preaudits all purchase orders, receipts, and disbursements Prepares payrolls Prepares & issues all checks Bills property & other taxes, special assess- ments, and utility & other service charges Maintains investory of all municipal property |

Makes studies of property values for assessment purposes

Prepares & maintains property maps & records Prepares assessment roles Assesses property for taxation Distributes special assessments for local improvements |

Collects all taxes, special assessments, utility bills

& other revenues

Issues licenses & permits Maintains custody of all city funds Disburses city funds on proper vouchers or warrants |

Purchases all materials, supplies, & equipment

for city departments

Establishes standards & prepares specifications Tests & inspects materials and supplies purchased by the city Maintains warehouses and central stores system Provides certain central services such as mailing, duplication, etc. Administrers city's insurance program |

Conducts studies for development & administration

of budget system

Assembles budget estimates & assists Chief Administrator in preparation of budget document Acts as agent of Chief Administrator in controlling the administration of the budget by executive allotments, etc. Conducts studies relative to improvements in administrative organization & procedures |

*The Budget Officer often is responsible directly to the Chief Administrator, being physically located in the Finance Department to minimize duplication of records. In many cities, the Finance Director also serves as the Budget Officer.

The chief executive is responsible for: (1) formulating long-range plans for the entire organization; (2) preparing and administering the annual and capital budget; (3) maintaining the financial reporting activities; and (4) developing related systems for measuring program accomplishments.

A governing body (for example, a board of directors, city council, board of commissioners): (1) determines overall fiscal policy; (2) approves the budget for the organization; (3) adopts revenue and expenditure authorization measures; and (4) holds the chief executive accountable for the effectiveness of fiscal procedures and program results.

Day-to-day financial responsibilities often are distributed among five offices: Controller, Treasurer, Assessor, Purchasing Agent, and Budget Officer. The Budget Office may operate as one of the divisions of a Department of Finance or as a separate unit directly responsible to the chief executive. This latter arrangement reflects the policy emphasis of the budget as contrasted to the line emphasis of the other divisions.

Endnotes

[1] Peter H. Rossi, Howard E. Freeman, and Sonia Wright, Evaluation: A Systematic Approach (Beverly Hill, Calif.: Sage Publications, 1979), p. 283

[2] Fremont E. Kast and James E. Rosenzweig, Organization and Management (New York: McGraw-Hill, 1979), pp. 416-417.

[3] Robert J. Mockler, The Management Control Process (New York: Appleton-Century-Crofts, 1972), p. 2.