energy-water nexus

energy-water nexus

Coupled Environmental-Financial Decision Support Systems for the Energy Utilities Industry

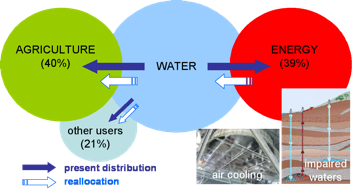

What is the Energy-water Nexus? Though perceived as separate objectives, energy and water sustainability are coupled challenges. Water is needed for fuel processing and power generation, while energy is required to convey water to populations in arid regions. The interdependence of the nation’s energy and water infrastructures achieves its most visible nexus in electricity production from coal-, gas- or uranium-fueled thermoelectric power plants that require massive, reliable water supplies for cooling of turbine exhaust, scrubbing of stack gases, and other process needs.

The Value of Water to Energy Utilities. The National Energy Technology Laboratory (NETL) projects that the majority of new power generating capacity installed between 2005 and 2030 will be in arid regions, including southeast, southwest, and western states.

Water constraints and other water risks such as elevated water temperature and biofouling result in an increased frequency of de-rating events (reduction in power production capacity) due to condenser back-pressure buildup, obstruction of cooling circulating water flow through condenser tubes, or insufficient steam generation. Moreover, financial markets react to corporate exposure and management of climate and water scarcity risks. The options include:

Buy energy on open or regional market to meet long term purchasing contracts

Buy energy on open or regional market to meet long term purchasing contracts

Invest in water conservation technology

Invest in water conservation technology

Defer investment in technology until better understanding of uncertainties

Defer investment in technology until better understanding of uncertainties

R&D on new solutions (innovation)

R&D on new solutions (innovation)

Real Options Analysis (ROA) in Sustainability Finance: This project focuses on the development and application of a decision support system (DSS) that incorporates environmental uncertainties in a real options financial framework to make time-dependent investment decisions in alternative cooling technologies. ROA enables a nuanced quantitative approach to modeling the impact of uncertainty, and to account for the flexibility of strategic investment when faced with uncertain future cash flows.

Sustainability issues are highly subject to policy, market and product pricing uncertainties

Sustainability issues are highly subject to policy, market and product pricing uncertainties

These uncertainties are usually taken into account as probability weights to compute an expected value of discounted cash flow (DCF).

These uncertainties are usually taken into account as probability weights to compute an expected value of discounted cash flow (DCF).

DCF does not quantitatively take into account investment risks and the value for decision-makers and managers of keeping their investment options open.

DCF does not quantitatively take into account investment risks and the value for decision-makers and managers of keeping their investment options open.

ROA offers a nuanced approach to strategic investment that quantitatively takes into account investment risks and the value of the open options for budget decision-makers.

ROA offers a nuanced approach to strategic investment that quantitatively takes into account investment risks and the value of the open options for budget decision-makers.

This area presents an entirely new venture for our research group, reflecting my recent interest in entrepreneurship research and value chain analysis for competitive positioning of technology-based ventures has matured through teaching and investment advising to the point where valuable academic contributions can be made.

Publications:

1.Wolfe, J. (partner at LimnoTech) 2008. Costlier, scarcer supplies dictate making thermal plants less thirsty. Power Magazine, January 2008.

2.Freedman, P., R. Goldstein, and P. Adriaens. 2005. Great Lakes Region Water Sustainability Research Workshop, SWRR_Final_Report.pdf. Sponsored by the Sustainable Water Resources Roundtable, Washington, DC.

3.Rice, J. 2009. Water Resource Risk and Technology Investment under Uncertainty: A real options approach to the valuation of water conservation technology at a thermoelectric power plant. Master’s Thesis, University of Michigan (Water_and_Uncertainty_ROA_JRice.pdf)