teaching

teaching

Here’s an interesting dichotomy...

One the one hand, venture capital-backed start-ups are an important source of innovation and technological development and serve as a major source of new wealth creation. In fact, initial public offerings from venture-based startups have accounted for one third of the market value of all initial public offerings in the US each year.

On the other hand, the statistics of new business creation from research and development are not very encouraging. Take for example the following:

2% of the disclosures in the research university technology transfer pipeline results in the development of a business;

2% of the disclosures in the research university technology transfer pipeline results in the development of a business;

For every successful company, there is a two order of magnitude of failed or unsuccessful ventures;

For every successful company, there is a two order of magnitude of failed or unsuccessful ventures;

On average $30M of R&D expenditure results in a successful company;

On average $30M of R&D expenditure results in a successful company;

Less than 1% of business plans submitted to investors will be successful in raising capital

Less than 1% of business plans submitted to investors will be successful in raising capital

At the faculty and student level, the buzz on entrepreneurship has largely translated into the narrow perception that “we need to spin off more companies from research”. Clearly, this has also become a priority for the State of Michigan, the City of Ann Arbor, and the UM office of technology transfer, driven by the loss of jobs from the automotive sector, Pfizer’s closing of its Michigan facilities, and the launch of SPARK as a hub for entrepreneurial startup companies.

The launch of successful new companies from university R&D is a dividend from the marriage of programmatic efforts within the university and capital investment from the financial sector in the startup realm, but this is only the end of a long road.

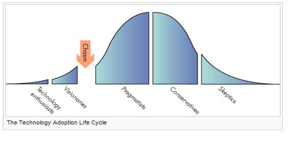

As universities are striving to increase entrepreneurial activity, there needs to be an educational component that integrates value creation in engineering R&D. The reason is that failure is often driven by the overemphasis on technology, in the absence of understanding market needs, unawareness of strategic principles that help positioning the technology-based product in the context of existing industries in this innovation space, and a fiscally-sound value proposition for investors or partners to enable the venture.

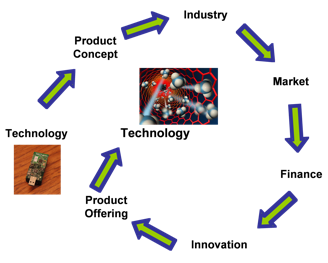

This entrepreneurship course focuses on the large looming question that needs to be addressed: Is This Problem Worth Solving? To answer that question, the course is structured around student projects, and breaks the problem down to 5 key areas: value chain, strategy, market, finance, and innovation.

1.Value chain: Is your business focus in a position to capture value?

2.Strategy: What is the competitive differentiator of the new technology or concept? How is the company positioned vis-a-vis competition?

3.Market: What is the unmet target market need? Micro/macro-markets?

4.Finance: Can you build a sustainable business on your product, and provide acceptable ROI?

5.Innovation: What is your strategy to sustain new products and expand market reach?

The ENGR_520_Syllabus_W2009.pdf for Fall 2008 is available from this link, and a sampling of venture challenge homeworks can be found here (Homework Venture Challenge.doc.)

Entrepreneurial Business Fundamentals (ENGR 520):

Is This Problem Worth Solving?